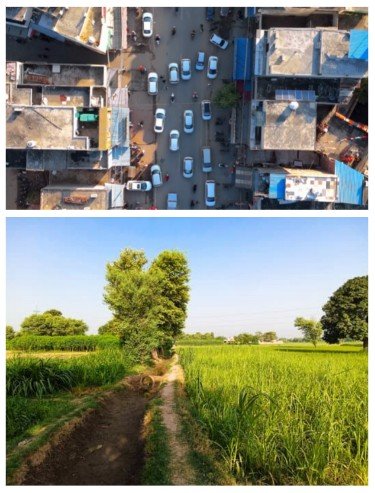

Saptrishi Soni: Punjab, once hailed as India’s “food bowl” and a beacon of agricultural prosperity, is now confronting an alarming economic decline, according to a recent comprehensive analysis. A study titled “Walking with the Ups and Downs of Punjab Economy,” conducted by Professor Ranjit Singh Ghuman of Guru Nanak Dev University, Amritsar, paints a sobering picture of the state’s financial health. The research highlights Punjab’s consistent economic underperformance since 1992, noting that between 2014–15 and 2022–23, its average annual growth rate was a mere 4.62%, significantly trailing the national average of 5.67%. This decline has seen Punjab’s ranking in per capita income plummet from the top position to 10th among 18 major states by 2022–23, overtaken by states like Gujarat, Karnataka, and Telangana.

The study attributes this downturn to a multifaceted failure in economic diversification, coupled with low investment, widespread industrial stagnation, and persistent fiscal mismanagement. Evidence of industrial decline is stark, with over 18,700 industrial units reportedly shutting down between 2007 and 2014, Amritsar alone accounting for 43% of these closures. The agricultural sector, which once contributed a dominant 57.3% to Punjab’s Gross State Domestic Product (GSDP) in 1970–71, now accounts for only 23.22% as of 2022–23. Despite this significant shift, the state notably lacks a formal agricultural policy to guide its future, leaving a critical void in strategic planning.

| Key Economic Indicators: Punjab’s Fiscal Health at a Glance Average Annual GSDP Growth Rate (2014-15 to 2022-23) 4.62% National Average Growth Rate (2014-15 to 2022-23) 5.67% GSDP Contribution from Agriculture (1970-71) 57.30% GSDP Contribution from Agriculture (2022-23) 23.22% Per Capita Income Ranking (2022-23) 10th (among 18 states) Investment Deficiency (2022-23) Rs 84,923 crore Outstanding Debt (Projected for 2025-26) Rs 4.17 lakh crore Debt as % of Projected GSDP (2025-26) 46.80% Revenue Spent on Debt Servicing (%) Over 41% Revenue Spent on Salaries, Pensions, Subsidies (%) 57.50% Youth Unemployment Rate (%) 26.33% | |

A major concern is the state’s burgeoning debt. Punjab’s outstanding debt is projected to reach an alarming Rs 4.17 lakh crore, which amounts to 46.8% of the projected GSDP for 2025–26. This fiscal strain is compounded by the fact that over 41% of the state’s revenue is consumed by debt servicing alone, while an additional 57.5% is spent on salaries, pensions, and subsidies. This leaves negligible room for crucial developmental spending, effectively trapping the state in a “development ICU” as described by the study. The economic stagnation has also fueled a worrying rise in youth unemployment, pushing many young people towards migration abroad, often through illegal channels, as the industrial and services sectors have failed to generate sufficient alternative job opportunities.

In response to these challenges, the Punjab government has announced a record Rs 1.24 trillion Annual Development Programme (ADP) for the fiscal year 2025-26. This ambitious program prioritizes social sectors, infrastructure development (including a Rs 3,500-crore road infrastructure project covering 19,000 km of link roads), and production sectors, aiming to accelerate economic growth and enhance public services. However, the government’s controversial land pooling policy, intended for urban development, has ignited strong opposition from political parties like the Bharatiya Janata Party (BJP) and the Shiromani Akali Dal (SAD). They argue that the policy is a direct assault on farmers’ interests, potentially stripping them of their land rights and economic freedom. While the government asserts transparency and voluntary participation in the scheme, the political outrage and farmer protests highlight a deep-seated mistrust.

Punjab’s economic trajectory, from its peak as the “food bowl of India” to its current state of fiscal distress, exemplifies the profound challenges inherent in transitioning from an agriculture-dominated economy. The state’s historical success in the Green Revolution, while transformative, appears to have inadvertently fostered an over-reliance on a single sector, preventing the necessary diversification into manufacturing and services. The absence of a formal agricultural policy further exacerbates this issue, hindering the sector’s ability to adapt and innovate in a changing economic landscape. This structural imbalance has contributed to industrial stagnation, low investment, and a “debt-trap” where a significant portion of revenue is consumed by committed expenses, leaving little for essential developmental investments. This situation underscores the critical need for comprehensive, long-term economic planning that fosters growth across diverse sectors, moving beyond a singular focus.

The substantial portion of Punjab’s revenue allocated to salaries, pensions, and subsidies, as highlighted by the study, points to a governance model heavily influenced by populist measures. While such policies may provide immediate relief or garner political support, they can severely deplete state coffers, leading to increased borrowing and a perpetuation of the debt cycle. This fiscal reality significantly constrains the government’s capacity to invest in critical areas such as infrastructure and human capital development, which are vital for sustainable economic revival. The tension between short-term political expediency and long-term fiscal prudence is a central theme in Punjab’s current economic narrative.

The contentious land pooling policy, despite the government’s assurances of transparency and voluntary participation, has become a focal point of political opposition and farmer protests. This situation reveals a deeper underlying issue of public trust and the perceived fairness of government interventions, potentially stemming from past land acquisition practices. The debate over this policy transcends mere administrative procedure; it acts as a crucial indicator of the government’s ability to implement large-scale development projects equitably and transparently, particularly when they impact the livelihoods and rights of the state’s politically influential farming community. The outcome of this policy will be a significant test for the government’s approach to inclusive development and its capacity to build consensus among stakeholders.